How to Get Best USD to EURO

Exchange Rate

Navigating the volatile landscape of currency exchange, particularly from USD to EURO, is a critical task for professionals aiming to maximize financial outcomes in a market swayed by economic indicators, political events, and market sentiment.

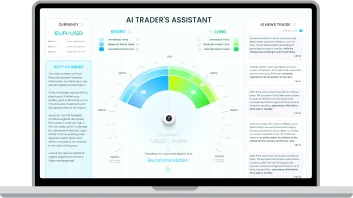

This article delivers practical strategies and insights for those involved in currency exchange, focusing on leveraging technology and forecasting techniques to secure favorable exchange rates.

By understanding the intricacies of forex market dynamics and adopting advanced tools, including AI, for rate prediction, readers will be equipped to make informed decisions, enhancing their operations in the dynamic international market.