Experience a trading revolution by integrating Trader`s Assistant for comprehensive EUR/USD analys and enhanced decision-making

Leverage the capabilities of AI to forecast EURO/DOLLAR trends with unmatched precision throug advanced EURO DOLLAR analysis

TRY FOR FREE

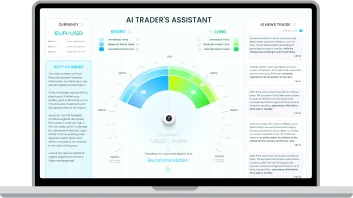

Unique "Forecast Dial"

The dial has two pointers, each corresponding to a neural network forecast. One pointer shows short-term predictions for rising currency rates, and the long-term for falling currency rates.

Around the dial, there are four colored bars that represent long-term forecasts:

EUR/USD Price Movement Analysis:

How to Predict with Precision

Deciphering the movement trend of the EUR/USD pair remains a crucial challenge for forex market participants.

To navigate this, a blend of three analytical approaches is employed, each serving a specific purpose in the larger EUR/USD market analysis framework. These techniques furnish the necessary understanding to make educated choices in the dynamic forex market. Grasping these approaches is vital for predicting the pair's fluctuations with enhanced precision.

Types of EUR/USD analysis

Forex trading involves a blend of artistic intuition and scientific analysis to precisely anticipate currency trends.

A range of strategies are employed by traders and analysts to forecast the fluctuations in the EUR/USD pair, one of the most popular and actively traded currency duos.These strategies fall into three main categories of analysis, each offering unique insights and tools for understanding and anticipating market behavior. Grasping the essence of these analytical approaches is crucial for anyone looking to navigate the intricacies of the EUR/USD market effectively. Let's delve into each of these methods to uncover how they contribute to a comprehensive trading strategy.

EUR/USD Fundamental Analysis

In forex trading, particularly when focusing on the EUR/USD currency pair, fundamental analysis entails the examination of economic indicators, monetary policies, and political occurrences that may influence the exchange rate between the Euro and the U.S. Dollar.

- Pros of Fundamental Eur Usd Analysis:

- Cons of Fundamental Analysis:

-

Comprehensive Economic Outlook

It offers an in-depth insight into the economic well-being of both the Eurozone and the United States, which are critical for long-term currency valuation.

-

Time-Consuming

Requires considerable time for the collection and examination of an extensive range of data points.

-

Policy Insight

Provides perspectives on the monetary strategies of central banks, including interest rate adjustments and quantitative easing measures, which can substantially influence the strength of currencies.

-

Information Overload

The overwhelming abundance of economic reports and data often presents itself as both copious and at times, conflicting.

-

Predictive of Major Trends

May assist in forecasting long-term patterns rooted in economic cycles and major political occurrences.

-

Delayed Reactions

Markets may not immediately respond to economic reports due to speculative or unforeseen factors.

-

Useful for Long-Term Investments

Particularly beneficial for investors looking to hold positions for an extended period.

-

Not Ideal for Short-Term Trading

Economic data points are often too broad to be applicable for short-term tactics or day trading strategies.

-

Incorporates Geopolitical Events

Takes into account geopolitical developments, providing a holistic view of potential external shocks to currency rates.

-

Subject to Interpretation

Economic figures can be interpreted in various ways, which can lead to differing opinions on the currency's direction.

Pros of Fundamental Eur Usd Analysis:

-

Comprehensive Economic Outlook

It offers an in-depth insight into the economic well-being of both the Eurozone and the United States, which are critical for long-term currency valuation.

-

Policy Insight

Provides perspectives on the monetary strategies of central banks, including interest rate adjustments and quantitative easing measures, which can substantially influence the strength of currencies.

-

Predictive of Major Trends

May assist in forecasting long-term patterns rooted in economic cycles and major political occurrences.

-

Useful for Long-Term Investments

Particularly beneficial for investors looking to hold positions for an extended period.

-

Incorporates Geopolitical Events

Takes into account geopolitical developments, providing a holistic view of potential external shocks to currency rates.

Cons of Fundamental Analysis:

-

Time-Consuming

Requires considerable time for the collection and examination of an extensive range of data points.

-

Information Overload

The overwhelming abundance of economic reports and data often presents itself as both copious and at times, conflicting.

-

Not Ideal for Short-Term Trading

Economic data points are often too broad to be applicable for short-term tactics or day trading strategies.

-

Delayed Reactions

Markets may not immediately respond to economic reports due to speculative or unforeseen factors.

-

Subject to Interpretation

Economic figures can be interpreted in various ways, which can lead to differing opinions on the currency's direction.

In summary, fundamental analysis remains a pivotal instrument for grasping the core elements that sway currency valuations over an extended period. However, its complexity and the delayed market reaction to new information can limit its utility for short-term trading.

EUR/USD Technical Analysis

This analytical approach concentrates on immediate price fluctuations and is favored by day traders and those seeking rapid, strategic transactions. It leans extensively on past price records and statistical patterns. Traders employ a range of charting instruments and technical indicators, such as moving averages, Bollinger Bands, and stochastic oscillators, to discern patterns and trends in the EUR/USD exchange rate. The basic premise is that past trading behavior and price changes serve as predictors of future outcomes. Often, this technique is combined with fundamental analysis to accurately time trading activities.

EUR/USD Sentiment Analysis

Often considered the most subjective form of analysis, sentiment analysis attempts to quantify the mood or psychological attitude of the market towards the EUR/USD pair."It encompasses assessing market commentary, surveying investor opinions, and examining trading positions and volumes. The objective is to gauge whether traders are bullish or bearish on the currency pair. Sentiment measures, like the Commitment of Traders (COT) report, offer a glimpse into the positioning of various trader categories within the forex market. Such analysis aids in grasping the collective mindset that frequently propels short-term market fluctuations.

Each of these analytical approaches presents a distinct viewpoint of the market. Fundamental analysis delivers a more comprehensive insight into economic foundations, whereas technical analysis furnishes tools for exact trading entry and exit strategies. Conversely, Sentiment analysis is instrumental in deciphering the current sentiment of market players. A balanced approach that combines elements of all three is often the most effective strategy for forecasting EUR/USD pair changes.

EUR/USD Price Action Analysis

This approach represents a facet of technical analysis that centers on price movements for making trading choices, independent of conventional indicators. It is based on the conviction that price changes inherently encapsulate all market factors affecting a currency pair at a particular moment.

Here’s a closer look:

-

Price Patterns

Traders employ candlestick chart patterns like head and shoulders or triangles to predict market continuations or reversals.

-

Candlestick Formations

Specific candlestick shapes, like dojis and hammers, signal potential market moves by reflecting trader sentiment.

-

Support and Resistance

Critical levels are monitored for indications of price pausing or altering course, owing to past market responses at these junctures.

-

Volume

Used to confirm the validity of price trends, where higher volume can signify a more significant price movement.

-

Trend Analysis

The market trajectory is determined by examining the sequence of highs and lows, where ascending sequences signal an uptrend and descending ones denote a downtrend.

Traders engaging in EUR/USD price action analysis frequently choose this method for its straightforward, 'unfiltered' trading perspective. This technique necessitates a profound grasp of market dynamics and a skill in discerning nuanced shifts in price movements.

EUR/USD Exchange Rate Analysis

Euro-dollar exchange rate analysis is a multifaceted approach that examines the factors influencing the value of the Euro against the U.S. Dollar.

Here's an overview:

-

Economic Indicators

Experts scrutinize various economic indicators from both the Eurozone and the United States to assess the overall economic condition. This evaluation process includes examining factors such as inflation rates, GDP progression, employment statistics, and manufacturing output. The analysis of these indicators provides insights into the potential movement of the exchange rate.

-

Interest Rate Differentials

Variations in interest rates established by the European Central Bank and the Federal Reserve can influence investor behavior. When the Federal Reserve opts to increase its rates, it could result in a stronger U.S. dollar compared to the euro, and the opposite effect may occur when rates are lowered.

-

Political Stability and Policies

Political events in Europe, such as elections or policy shifts, and U.S. political dynamics, can cause fluctuations in the exchange rate. Policies affecting trade, sanctions, or treaties are particularly influential.

-

Market Sentiment

This involves analyzing trader behavior and market emotions. Positive or negative sentiment can drive the EUR/USD exchange rate up or down.

Analysts aim to predict the euro-dollar exchange rate changes by examining these aspects, helping traders make informed decisions.

How to Use Forex Analysis for

Long- and Short-Term Forecasting

The three principal analyses—fundamental, technical, and sentiment—provide traders with a comprehensive toolkit for forecasting the EUR/USD exchange rate over different time horizons.

Short-Term Forecasting:

-

Technical Analysis

This is particularly useful for short-term forecasting. Traders utilize price patterns, candlestick formations, and other chart-based tools to make quick decisions. Technical indicators are tools that can provide signals for the optimal moments to enter or exit the market for day traders and those employing scalping strategies.

-

Sentiment Analysis

Short-term market movements can be driven by the sentiment or mood of the market participants. Tools like the Commitment of Traders (COT) report can indicate how different market segments are positioned and may signal imminent price movements.

-

Fundamental Analysis

While typically associated with long-term forecasting, certain fundamental events, such as unexpected interest rate changes or political announcements, can have immediate effects on the market, creating short-term trading opportunities.

Long-Term Forecasting:

-

Fundamental Analysis

Over the long term, fundamental analysis is key. Economic trends, monetary policy shifts, and long-term geopolitical events tend to have a sustained effect on the EUR/USD exchange rate. Through a comprehensive comprehension of these factors, traders are empowered to predict the broader market's future trajectories.

-

Technical Analysis

Long-term trends can also be identified through technical analysis. While day traders look at shorter time frames, long-term traders might analyze weekly or monthly charts to identify major trends.

-

Sentiment Analysis

Long-term sentiment analysis might involve examining the overall bullishness or bearishness of market analysts or the positioning of institutional traders over a more extended period.

Traders can gain a nuanced view of the market by using these analyses in tandem. Technical analysis provides precision in timing, while fundamental analysis offers context and sentiment analysis, which gives a read on the market's mood, all of which are essential for crafting well-informed choices in the realm of both short-term and long-term forex trading strategies.

Wrapping up

The essence of EUR/USD currency pair analysis lies in utilizing fundamental, technical, and sentiment insights to guide trading decisions. These methodologies form a strategic triad for traders to forecast market trends effectively.

AI Trader's Assistant elevates this strategy by integrating AI-powered analysis, offering real-time, tailored EUR/USD trend predictions. Its user-centric design and advanced features provide traders with a competitive advantage, making it an indispensable tool for navigating the forex market. Join now to harness the full potential of AI in your trading endeavors.

TRY FOR FREE