Introduction to Commodity

and Currency Trading

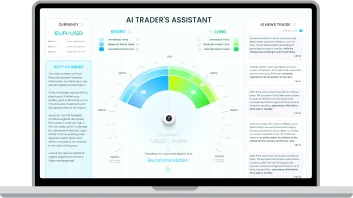

Commodity and currency trading are essential pillars of the global financial markets, deeply influencing economic trends and decisions worldwide. Commodities such as oil, gold, and agricultural products are traded on a vast scale, with their prices fluctuating based on supply and demand dynamics, geopolitical tensions, and variations in currency values. This trading is critical for managing risk and capitalizing on market movements.